The thing about energy that dazzles me the most is that it does not matter the effort, you can never get a truly solid grasp on every single side-effect stemming from market turmoil and fluctuations. Very soon you start to realise that, maybe, energy is the sole case where the good-old one size fits all apply perfectly as literally, everything is heavily dependent on it.

For instance, take the recent natural gas crisis and consequently record high prices ravaging Europe and Asia. Amongst the sectors affected by it, the worldwide production of fertilizers such as ammonia – an essential element to fabricate nitrogen-based chemicals – took a particularly hard hit. Nitrogen (N2), Phosphorus (P) and Potassium (K) are the three most important nutrients for plant growth, and their production involves a lot of energy.

In Italy, there’s a song written for children that talks about what you need to make things.

“to make a table, it takes wood

to make the wood, it takes a tree”.

The lyrics perfectly fit the fertilizer industry too. The making of fertilizers is, indeed, a highly capital-intensive activity since it entails a huge input of raw materials such as natural gas, by far the largest feedstock. With regards to ammonia, natural gas and electricity account for around 50-60 per cent of cash production costs, depending on price and efficiency levels. Moreover, ammonia is used to produce nitrogen fertilizers covering more than half of the worldwide demand.

A crunchy Gas crunch

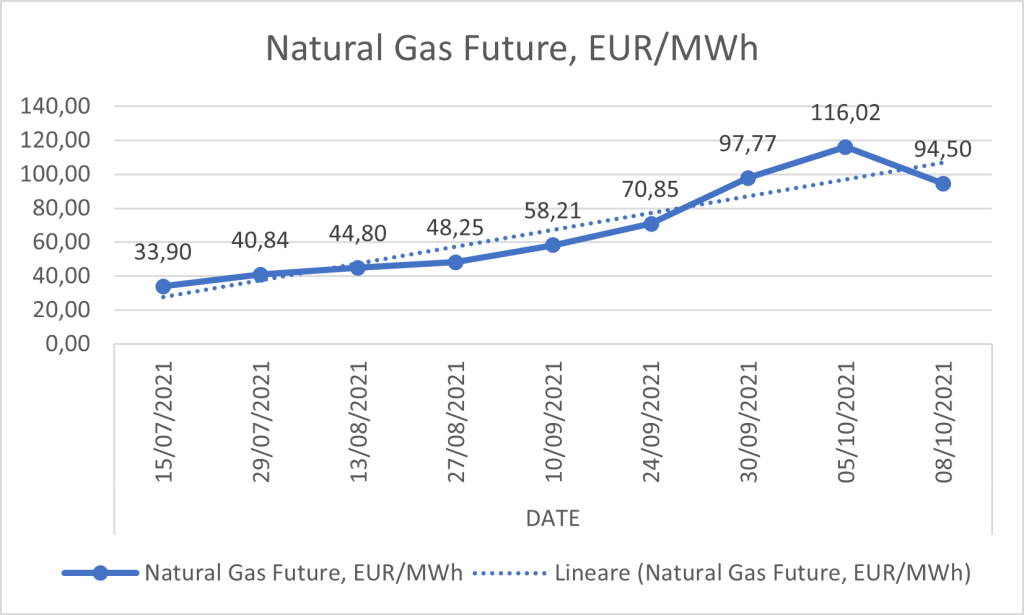

Since late January, natural gas prices in Europe have risen 250 per cent constantly exceeding 5 $/MMBtu, while growth in Asia not far off as it has seen a 175 per cent increase in the same period. In the United States (US), world’s largest producer of natural gas (over 20 per cent), prices have skyrocketed to heights last recorded in 2014.

Let’s analyse the reasons for that, shall we?

Firstly, we should never forget to take into consideration the extremely seasonal nature of gas demand. Generally, natural gas reserves undergo an “injection period” during summer when demand is low to be ready to meet higher needs when winter kicks in. Therefore, flexibility is a key element of whichever consideration upon the natural gas sector. Since January, European natural gas inventories have been particularly low compared to what they used to be in the past few years. According to data from Gas Infrastructure Europe’s (GIE) Aggregated Gas Storage Inventory, as of the 3rd of October 2021, storage levels were some 21 per cent lower than in 2020. Analysts have pointed towards last winter’s colder-than-normal temperatures and overall resumption of activities as decisive factors to explain drawdowns and consequent gas scarcity in Europe. Besides, this year’s natural gas injections have also been fewer (and slower) than usual affecting several storage facilities, particularly in Central Europe (Austria, Germany, and the Netherlands above all). This was partly due to declining natural gas production in Northwest Europe which dropped some 9 percent on a year-to-year basis and coal-to-gas switching which enhanced the demand surge. However, as we know, the bulk of natural gas supplies towards Europe come from abroad, particularly Russia (about 200 bcm/year or over 40 percent of total imports). As briefly mentioned in the article about Germany (here’s the link), Russian decision not to book additional supplies into mainland Europe amid wrangles with the European Union (EU) over the crucial Nord Stream 2 has also played an offsetting role. Not coincidentally, natural gas storage facilities owned by Gazprom – Moscow’s strategic energy pawn and biggest gas exporter – in Europe are particularly underperforming in terms of filling levels.

Meanwhile China’s hunger for natural gas has anything but grown in intensity. In recent weeks, Chinese authorities have held meetings with the main state-owned oil and gas companies – PetroChina, Sinopec and CNOOC -to draw plans to ensure supplies for the coming winter in a bid to prevent the shortages it experienced last year. That is likely to come in two ways: domestically through the ramping up of unconventional and offshore production and, externally, via sustained natural gas imports both through pipelines and cargoes (LNG) which seemingly puts China in a more favourable position in the eyes of exporters, thus further encouraging diversion of supplies away from European clients. The hope is that it should help buffer, even just in part, price spikes.

A “perfect storm”

The gas crunch escalated faster than many fertilizer producers were expecting, thus restraining them from passing exceeding costs to consumers. Demand for fertilizers worldwide has been growing for months driven by economic recovery and producers are prone to adopt a whatever it takes approach to secure supplies. However, if prices are going to increase excessively, that is likely to cause a huge backlash in the short-to-medium term as farmers would seek to reduce consumption. In some parts of the US, for instance, prices have grown threefold since the start of the year. According to economics of the International Fertilizers Association (IFA), the industry was caught by a “perfect storm” checking: high demand, high chemical prices, shortages of raw materials, trade constraints and bottlenecks causing shortfalls in the supply chain.

China, by far the most important potash (potassium chloride) producer, has not remained exempted from consequences either. As a result, it is now shutting off exports amid concerns about internal supplies causing worldwide shortfalls.

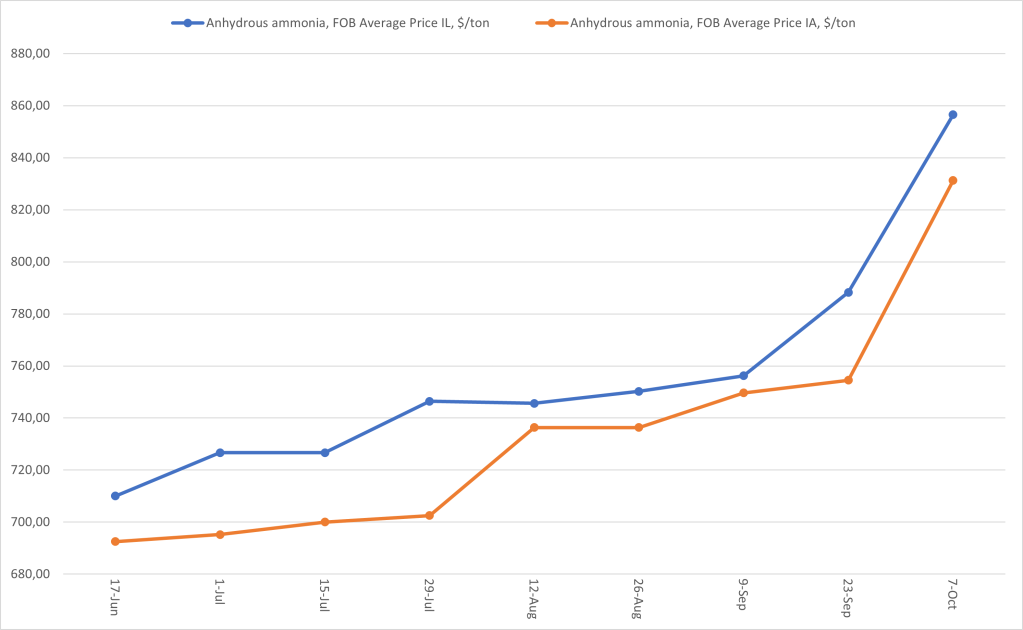

Last August (thus, before the gas crunch actually kicked in), prices of anhydrous ammonia in the US had already scored some 53 percent increase on a year-to-year basis topping at $746/ton. The last time it was above $ 700/ton was in 2014. As of the first week of October, they have gone past $820/ton in Illinois and Iowa, amongst the US largest agricultural States.

In Europe, the fertilizer industry generates around € 10.2 billion and counts over 120 production sites for 75,800 employees. On September 17th, Yara International ASA, the Oslo-based world’s largest trader of ammonia, announced it would curtail production in Europe by around 40 percent sparking panic in the market. Rising natural gas prices are making ammonia production unprofitable, particularly for European producers. Eventually, Yara opted to import enough from abroad to “maintain our fertilizer production at close to full capacity” although it is not clear when it is going to resume production within the region. BASF, a German-based chemical producer, was the latest to reduce output in his Antwerp and Ludwigshafen facilities.

Is there going to be not enough bread on our tables?

As overly exaggerated speculations about a food supply crisis started to mount, countries promptly reacted to prevent fertilisers shortages. In the UK, the government immediately announced subsidises to CF Industries, a major US nutrient manufacturer, to resume operations at one of its two plants – which together account for some 60 percent of total UK demand for carbon dioxide (CO2). CO2 is a major by-product of ammonia production widely used in the food industry, from meat producers to food packaging – as it had initially decided to halt operations.

Meanwhile, several natural gas exporters such as Norway and Ajerbaijan have said they are willing to expand supplies to Europe.

Flexibility we said. On Thursday, 7th of October, the TTF (Title Transfer Facility), the main natural gas spot market in Europe, plunged to 81.075 from closing at impressive 162.125 the day before. What does that mean? I have no idea for now, but, with storage levels still down and Russia doing its thing – though recently announcing it will exceed its contractual obligations – we are not out of the woods yet. As for the fertilizers industry, there is no doubt that high natural gas prices mean high margins when they manage to keep the revs up. That is why they are welcoming governments stepping in to bail them out.

Looking ahead, higher nutrient costs risk exacerbating global food inflation, particularly in poorer nations where alternatives to ammonia are far from being at agrobusiness scale. On Thursday, Brazilian President Jair Bolsonaro said his government planned to increase the country’s production of fertilizer to make it less reliant on imports. In Canada, farmers are already starting to reconsider plans for next year’s planting season with a sole aim: using as little fertilizers as possible.

REFERENCES

- BASF ($ETR: BAS)

- CF Industries Holdings, Inc. ($NYSE: CF)

- Elizabeth Elkin, Food Prices Poised to Surge With Fertilizer at Highest in Years, Bloomberg, September 20, 2021. Available at https://bloom.bg/2WSDJeW

- Esther Webber and Matt Honeycombe-Foster, UK agrees ‘short-term’ bailout for CO2 firm amid food supply fears, September 22, 2021. Available at https://politi.co/3aA6HUp

- Fertilizers Europe, 2018

- Gas Infrastructure Europe’s (GIE) Aggregated Gas Storage Inventory

- Intercontinental Exchange, Inc. (ICE).

- Hanna Ziady, UK bails out an American company to prevent food supply crisis, CNN, September 22, 2021. Available at https://cnn.it/3v2t0eM

- Megan Durisin and Deirdre Hipwell, Energy Crisis Brings Fresh Chaos for Battered U.K. Food Supplies, Bloomberg, September 17, 2021. Available at https://bloom.bg/2YF2gFb

- Reuters, Brazil’s Bolsonaro pushes fertilizer project as he warns of shortage, October 8, 2021 Available at https://reut.rs/3DndWeB

- Reuters, Yara brings ammonia to Europe after gas price hike, CEO says, September 20, 2021. Available at https://reut.rs/3loxGbF

- Sylvia Traganida, INSIGHT: Fertilizer prices on the rise as energy crisis, tight availability, bite, October 1, 2021. Available at https://bit.ly/3BtC4LZ

- S&P Global Platts, BASF cuts ammonia production in Antwerp, Ludwigshafen on gas price, September 27, 2021 . Available at https://bit.ly/3AoqFfb

- United States Department of Agriculture, 2021

- Yara ($OTCMKTS: YARIY)

- Vitaly Yermakov, Big Bounce: Russian gas amid market tightness. Key Takeaways for 2021 and Beyond, Oxford Energy Comment, September 2021.